Equipment Leasing vs. Financing

There are many ways to acquire heavy equipment, whether replacing an existing machine or expanding your fleet for a specific project.

Two popular options for acquiring heavy equipment are financing and leasing heavy equipment. Financing allows you to pay for the equipment over time, while leasing allows you to pay a flat monthly fee to use the equipment for a specific period. Equipment financing and leasing can provide benefits, but one is a better fit for your business.

Estimated read time: 6 minutes

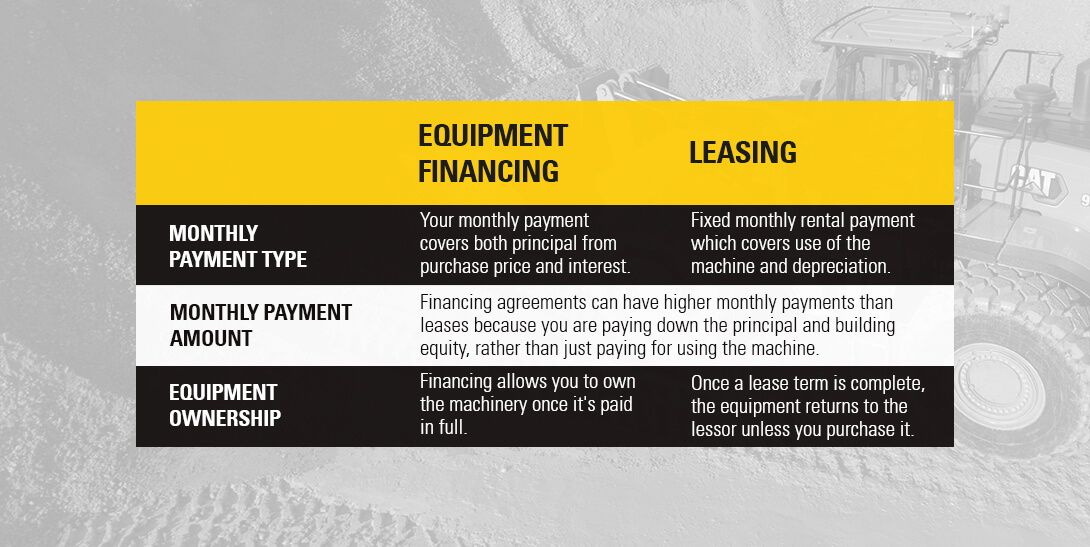

WHAT IS THE DIFFERENCE BETWEEN LEASING VS. FINANCING EQUIPMENT?

Understanding the key differences between equipment leasing and equipment financing can help you make informed decisions for your business. Here's a concise comparison of the two options.

Equipment Leasing

- Ownership: The lessor retains ownership of the equipment

- Monthly Payments: Fixed monthly payments

- End of Lease Options: Extend the lease, return the equipment, or purchase it

Equipment Financing

- Ownership: You own the equipment once all payments are completed

- Monthly Payments: Fixed monthly payments that include the equipment cost, interest, and fees

- End of Loan: You own the equipment outright

Do you know which option is best for your business?

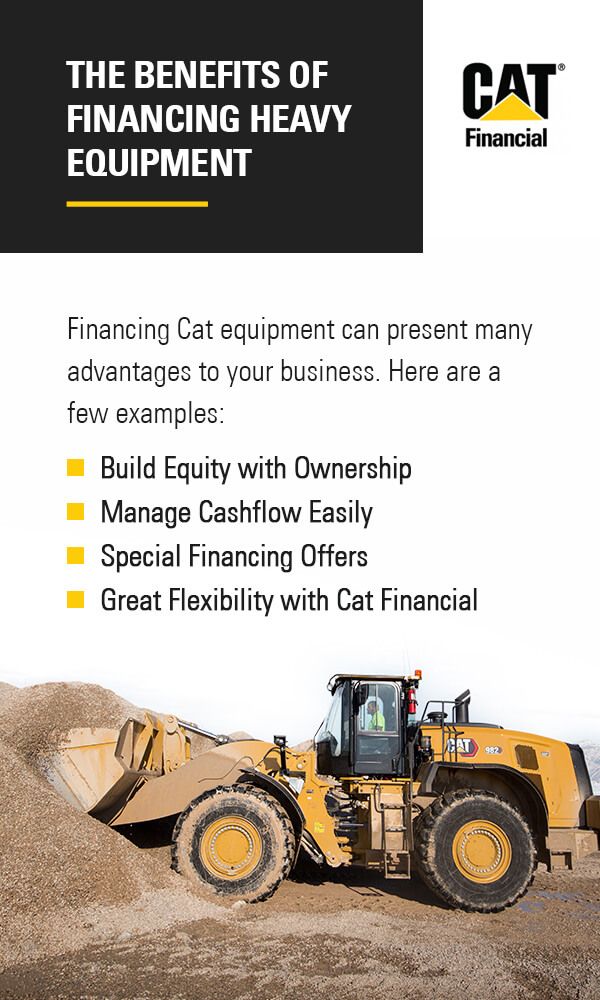

WHY SHOULD I FINANCE HEAVY EQUIPMENT?

Diving deeper into equipment financing versus leasing can help you make a more informed decision about which option is best for you and your business.

Financing Cat equipment could be an excellent option for your business if you are interested in preserving cash flow and paying over time. Cat Financial can offer competitive rates and flexibility that other financial institutions may not.

Reasons to finance a Cat® machine:

Spread out the financial obligation: Financing equipment allows you to spread out the total cost over a more extended period. Instead of making a large payment all at once, you can make smaller payments across months or years, otherwise known as paying in installments. Personalized payment schedules can be implemented for qualified customers.

Multiple financing options: There are typically numerous financing options available for companies. The various options can feature different interest rates or monthly sums. You can work with the financing firm to select the best plan for your needs. For instance, dependable finance companies like Cat® Financial offer various financing options.

Acquire multiple machines at once: Financing is a great way to get multiple pieces of equipment simultaneously. You can invest significantly to grow your business and take on more work by paying for equipment over time rather than in total upfront.

Special Offers: Cat Financial typically offers special financing rates for new and used Cat equipment. These limited-time offers can help you save on interest. Contact your local Cat dealer to see what offers are available in your area.

Financing Cat equipment can present many advantages to your business. Here are a few examples:

1. Build Equity with Ownership

One of the most significant benefits of equipment financing is that you can build equity as your payments contribute to the purchase price of the equipment. Once the machine is paid in full, you will own the equipment and have it for as long as it’s needed.

2. Resale Value

When you finance equipment, you own it at the end of the loan term. This means you can sale the machine and recoup part of your investment. This can impact your overall costs and financial planning. A high resale value, which Cat equipment is known for, can offset the initial purchase price and significantly reduce the total cost of ownership.

3. Special Financing

Special financing offers can significantly influence the decision to finance or lease equipment. These offers often include reduced interest rates, flexible payment terms, or other incentives that can make financing more attractive. Cat Financial frequently provides special financing rates for both new and used Cat equipment that can make ownership more affordable.

With an equipment lease, you can use equipment to the fullest for a certain amount of time. Three years is a common lease term. Once the lease ends, customers have multiple options for what to do with the equipment.

Here are more great reasons to lease heavy equipment:

1. Good for Short-Term Needs

Leases can accommodate short-term projects and needs. An upcoming project might need machinery your company doesn't own or have available in the equipment fleet. Instead of investing, you can lease the machine for the project's duration. That way, you stay within your budget and complete the job. You don't have to invest in equipment you only plan to use once.

2. Lower Budget Impact

Leasing can also have a lower impact on your company's budget. A lease involves a fixed monthly payment, often lower than financing payments. You may not have to pay extra interest fees each month or make a down payment at the time of purchase. Some lessors like Cat Financial offer 100% financing for qualified customers, which includes coverage for delivery fees and other taxes. With 100% financing, you avoid down payments or additional upfront costs.

With less financial responsibility each month, you have more control over your available credit. You can use the additional capital for other business needs. And you can plan your monthly expenses more efficiently with a consistent monthly payment amount. Overall, leasing allows you to get new equipment with a minimal financial impact on your business.

3. Try New Equipment Features and Technology

Another advantage of leases is testing the latest equipment features and technology. Lessors typically supply a wide variety of equipment options, including newer models with the latest technology. Thus, allowing you to try it before you buy it.

4. Flexible Payment Options

Lastly, leases for heavy equipment are available in many different options. Financial firms offer a variety of payment structures, from monthly to semi-annually. You can work with your provider to find the right payment amount and schedule for your company. Leases are also typically quicker to set up than financing agreements, making it easier to get started with the equipment.

If your schedule changes and you finish with the equipment earlier than expected, many lease providers can also help you complete your financial obligations early.

Cat Financial offers three options to qualified customers at the lease end:

- Return the equipment

- Extend your lease

- Purchase the machine

Another leasing option is a lease to own. For Cat Financial, this is our finance lease. With finance leases, you make regular payments on equipment over a specific time. The financial institution retains equipment ownership until you have completed all payments, then ownership transfers.

Leasing to own is an excellent choice for companies that want to own the equipment. You can maintain a monthly payment while deciding whether the machinery meets your needs. This option also makes it easier to purchase heavy equipment that is out of your budget.

A lease-to-own structure usually follows three steps:

You enter a lease agreement with the option of purchasing the equipment once the lease ends.

The lessor calculates a percentage of each payment that will contribute to the overall purchase price.

Once the lease ends and all payments are satisfied, you can pay the remaining balance to gain complete ownership.

This structure can sometimes cause you to pay a higher overall equipment cost. Companies should ensure they will have the means to pay the leftover balance once the lease ends. If not, they'll have to return the equipment.

EQUIPMENT LOAN OR LEASE? WHICH IS BETTER?

Both equipment leasing and financing can present many benefits for your construction business.

If your company is deciding between financing or leasing equipment, there are a few things to consider:

Equipment cost: Consider what type of equipment you need and its total cost to own, run, and maintain. Then, compare the typical cost to your budget. You can work with leasing and financing firms to find a monthly price that meets your available funds.

Equipment Versatility: Think about how essential the equipment is to your company. Is it a piece you need to use daily or something that will only suit a specific application? Some equipment can be outfitted with different attachments to make it more versatile. Considering that the equipment will become essential to your company's daily operations, consider a long-term option like financing. That way, you can eventually own the piece and use it regularly. But if you only need it for a short duration, a lease might suit your needs better.

Equipment Needs: Think about how often you plan on using the machinery. An investment is worth it if you know you'll use the equipment regularly. But a lease provides a shorter solution for equipment you might need for only one project.

Resell Opportunities: Consider your future financial goals. Many companies buy equipment to resell it later. Financing might be a better option if your goal is to recoup part of your initial investment. Once you own the equipment, you could use it regularly or resell it.

Choosing between financing and leasing depends on your business needs and financial flexibility. It's essential to find the right financial institution that understands the unique needs of your business.

Popular Articles About Cat Financial

Check out our blog for quick, insightful reads covering everything from small business equipment leasing and business equipment loans to tax tips and advice on growing your business.

-

How Does Small Business Equipment Financing Work?

Looking into financing equipment for a small business? See how small business equipment financing works and why you should consider lease and financing options.

Read More -

Caterpillar Pay for Use and How it Can Help Your Business

Discover how the Caterpillar Pay For Use™ program can improve your cash flow and offer more convenience and flexibility in your daily business operations.

Find Out More -

Financing vs. Paying Cash for Equipment

If you're deciding between financing vs paying cash for your equipment, we can help. Read the benefits of financing your equipment purchase, even with cash on hand.

Find Out More -

Cat® Equipment Financing Requirements

Our equipment financing requirements aren't complicated. See the four key factors we consider when you apply to take advantage of Cat equipment financing.

Learn More